You’ve probably heard of Bitcoin, but we doubt you’ve heard of Dentacoin, MedTokens, or Curecoin.

These are healthcare specific cryptocurrencies born from Initial Coin Offerings or ICOs. In this article, we’ll briefly recap the trend of ICOs (aka token offerings) and provide you with a summary financial analysis of how this trend has played out among 138 healthcare ICOs. The results to-date are enlightening, but disappointing. We believe there’s still potential for some projects to be successful.

Background

What’s an ICO? Here’s a quick take from Wikipedia and we’ll point you to an Appendix that will guide you to additional resources:

An ICO is a type of funding using cryptocurrencies…In an ICO, a quantity of cryptocurrency is sold in the form of “tokens” (“coins”) to speculators or investors, in exchange for legal tender or other cryptocurrencies. The tokens sold are promoted as future functional units of currency if or when the ICO’s funding goal is met and the project launches.

Autonomous Research found that ICOs raised over $ 7 billion in 2017 and are slated to raise $ 12 billion in 2018, with some mega projects raising billions of dollars each.

Two narratives have emerged around ICOs: one highlighting their promise and one that characterizes ICOs as everything wrong with cryptocurrencies.

In the first narrative, ICOs are “the future of funding—not only for cryptocurrency projects but for all startups”, a breakthrough in network design, and bring the ability to create “private economies”. They democratize fundraising, wrestle control out of centralized institutions and give it to users, align the incentives of a diverse ecosystem of stakeholders, and launch fundamentally new kinds of businesses built on cryptoeconomies.

The first narrative began to coalesce in 2016 and its intellectual roots can be gleaned by reading Chris Dixon’s Why Decentralization Matters and Joel Monegro’s Fat Protocol Hypothesis.

The second narrative highlights the dark underbelly of cryptocurrencies – that “ICOs are Cancer”. It points to the pump and dump schemes, lack of retail protections, lack of regulatory oversight, high levels of risk, lack of accountability, sky-high valuations, and presence of clowns like this guy.

In our experience, there’s truth to both narratives. We’ve seen some healthcare ICOs that could only be described as scams and some with team qualifications more suited to be cashiers at the local grocery store. We’re also seeing some superb ICOs – ones with coherent, well-detailed whitepapers and teams bringing decades of deep, relevant healthcare and business acumen.

What about healthcare ICOs? Over the past year, Vince has curated and crowdsourced a public list of 138 healthcare ICOs. We believe it’s highly representative of the universe of healthcare ICOs.

There are some commonalities among healthcare ICOs: they are all building some type of decentralized or distributed network and/or platform; they all make use of blockchain technology, and almost all bring a strong focus on some type(s) of healthcare data.

Beyond that, they are an extremely diverse group that spans the globe. Some of the categories on which these projects are focused include: integrity of healthcare supply chains, e.g., pharmaceuticals; distributed electronic health records (EHRs) and/or personal health records (PHRs), with control of data typically decentralized to individual patients; marketplaces for matching patients with healthcare providers, some providing real-time consultations; collection, storage, and/or analysis of genetic & other healthcare data; applying analytics and/or AI on various types of health data; organization of clinical trials processes; and miscellaneous clinical applications, devices, procedures.

Methodology and Key Findings

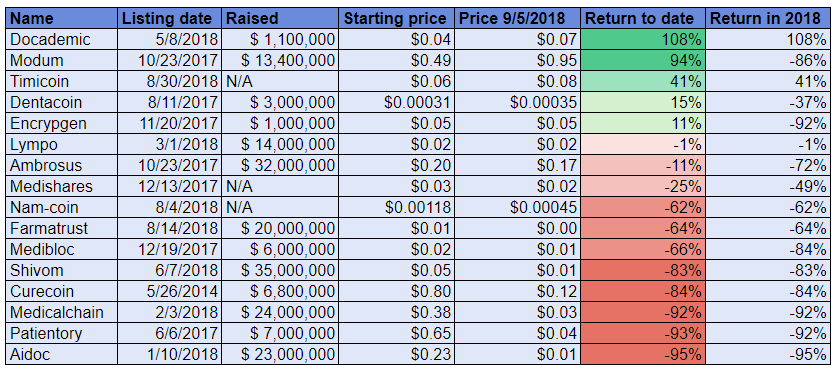

We started with a list of 138 healthcare ICOs. We cross-checked these against 1,916 coins cataloged on CoinMarketCap as of September 5, 2018. CoinMarketCap is the most comprehensive source of exchange-listed ICOs. A more detailed description of our methodology, findings and limitations can be viewed in these spreadsheets. The table below summarizes the key financial data.

Summary of Exchange-Listed Healthcare ICO Financial Returns Through September 5, 2018:

Some key findings from the starting list of 138 healthcare ICOs:

- 122 healthcare ICOs are not listed on any cryptocurrency financial exchange (e.g., Coinbase)

- 16 healthcare ICOs are listed on one or more exchanges

- Of these 16, 5 show a positive financial return since the date of their listing

- 2 show a positive return for the calendar year 2018 to-date

The 16 exchange-listed ICOs represent a 12% exchange-listing rate. On average the 16 listed healthcare ICOs had a -26% overall return rate, with the worst performing asset returning -95% and the best 108%.

We also collected market capitalization data on each of the exchange-listed healthcare ICOs. These ICOs collectively raised $ 186 million, not including the 3 healthcare ICOs on which we could not find data.

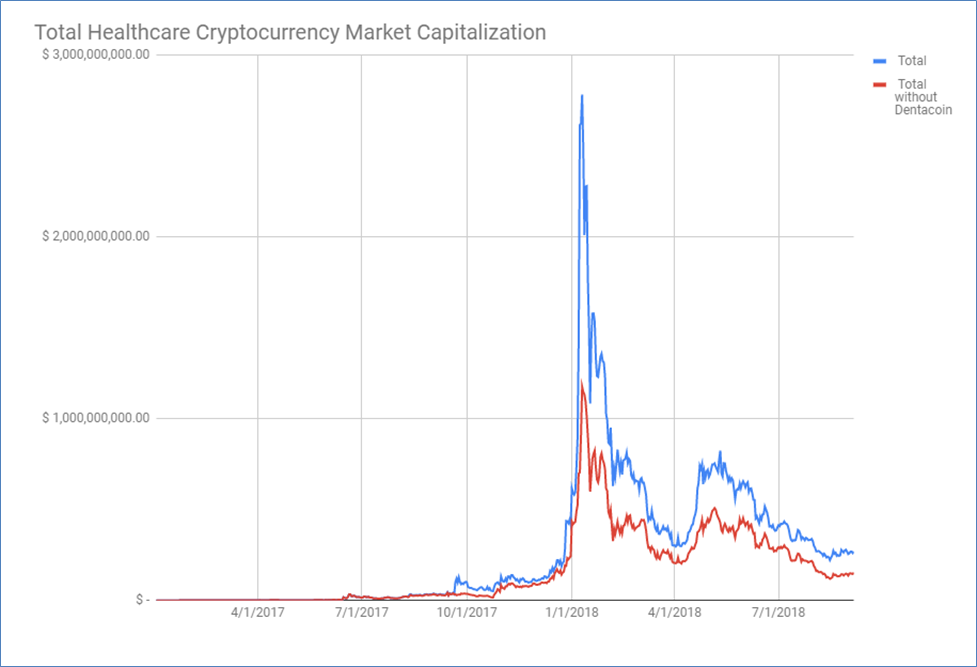

The market cap of the 13 healthcare ICOs for which data is available skyrocketed to a peak of $ 2.8 billion early in January 2018 and has since declined to $ 269 million. This data is greatly exaggerated by the inclusion of one outlier healthcare ICO – Dentacoin. If Dentacoin is excluded from the analysis, the peak market cap reached by the remaining healthcare ICOs is $ 1.1 billion in January and $ 153 million as of September 5, 2018.

Market Capitalization of 13 Exchange-Listed Healthcare ICOs Through September 5, 2018:

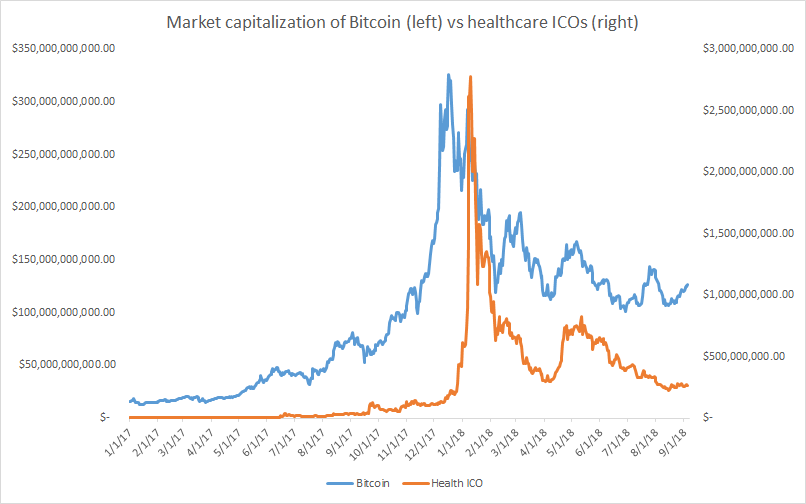

We also found that the total healthcare ICO market cap grew largely in tandem with the overall cryptocurrency market during 2017 and declined in tandem in 2018. The graphic below illustrates this trend. More specifically, we found a correlation of 75.1% between Bitcoin and the healthcare ICOs and 87.1% between Ethereum and the healthcare ICOs.

Comparison of Market Capitalization Patterns Bitcoin vs. 13 Exchange-Listed Healthcare ICOs Through September 5, 2018:

Discussion and Commentary

The first observation we’ll note is that there has been a substantial amount of healthcare ICO activity.

However, we would label the overall performance of the healthcare ICOs as “disappointing”. Only 5 reported positive returns since the date of their listing and 2 in 2018 to-date.

The overall ICO market has been declining since January 2018. Monthly funds raised by ICOs are down, and funding has shifted towards a few mega projects (like EOS and Telegram), big private sales, and smart contract platforms.

During the bull market of 2017, healthcare ICOs greatly benefited from burgeoning prices and market euphoria. It gave them access to easy capital (often non-dilutive as well), created a buzz around the industry, drove consumer interest in their products, made it is easier to hire top talent, and resulted in happy investors.

The bear markets of 2018 have hit healthcare ICOs hard. It has become extremely difficult to raise capital, ICOs don’t have organic user growth from an appreciating cryptocurrency, exchanges slow down listings, team morale suffers, and ICO big investors become unhappy.

Moreover, companies in the crypto space have difficulty establishing banking relationships and as a result, many hold their funds raised in cryptocurrencies (i.e., in Ether vs. $ USD). When prices fall, treasuries and most important project runways suddenly become much shorter than teams previously believed. As an example, a project that raised $ 10m late in 2017 might expend $ 2m in marketing and legal fees, and then pay year-end taxes; after the price of Ethereum dropped 80% in 2018, their initial $ 10m could suddenly be reduced to less than $ 2m.

The high overall correlation between healthcare ICO prices and cryptocurrency prices is also troubling. In a market that is well functioning and transparent, we would expect that prices would be based more on the performance of individual projects, rather than tied to a nascent and volatile market of speculative cryptocurrencies.

What should we make of the fact that only 12% of healthcare ICOs are listed on exchanges? There are some understandable reasons to choose not to be listed, or to delay getting listed. It is an expensive process, potentially costing up to $ 1m. Some teams are choosing to wait and get regulatory clarity before listing. The caliber of exchanges listing ICOs does not currently match the quality of exchanges listing publicly traded stocks.

Another possible explanation for healthcare ICOs low listing rate is that exchanges do not see healthcare cryptocurrencies as a market enticing enough to drive retail investing demand. A “new Bitcoin” is sure to excite people and generate retail investor trading, and thus generate revenue for exchanges, but a cryptocurrency made to “revolutionize FHIR based interoperability” or “drive value-based payments” doesn’t have the same sex-appeal.

But in the long-run, NOT being listed on an exchange will be a huge liability for ICOs. For investors, it means there is no easy way to buy and sell your tokens.

This liquidity is extremely important. First of all, it provides an onboarding ramp for the cryptocurrency, a way for people to get their hands on what’s necessary to use a crypto-product or service. Second, it provides an exit ramp for investors in ICOs to liquidate their positions. Investors will often times have locked up their capital for months in high-risk high return ICO ventures with the ultimate goal being an exchange listing. In the case that there is no listing, it becomes much more difficult, sometimes impossible, for an investor to sell the cryptocurrency they have bought. We believe almost all legitimate projects will seek listing over time, but we cannot tell which healthcare ICO projects are making this effort.

Our personal knowledge of the healthcare ICO market affirms the financial analyses. We are aware of few live pilots, let alone production scale projects. We invite executives from ICOs to provide comments on their successes and challenges.

Also based on our personal knowledge, we believe that most healthcare ICOs have not understood that their fundamental mission is network building, and in turn that they must focus on creating network effects. ICOs, when executed properly, could be amazing tools to achieve this purpose. Hardly any of the healthcare ICO whitepapers discuss community building or how they plan to undertake the growth hacking activities that are required to achieve network effects.

Moreover, cryptocurrencies are a new way of organizing human activity, and as such, they require new forms of governance. Again, we have seen little far-sightedness about how these networks will be governed. This reflects a lack of thoughtfulness in the current generation of projects; they have proven to be very effective at raising money, but less so at everything that comes after that.

While there has been a substantial evolution in standards, practice and regulatory guidance since the advent of ICOs, at the moment the evolving conventional wisdom around ICOs has become gloomy. It is hard to say what the future will hold.

We believe, under the right conditions, that the ICO model can prove to be an extremely effective way to bootstrap a network and launch an amazing service. Depending on your point of view, this past year might evolve to be cryptocurrency’s “Netscape moment” or it could simply be a rerun of the dot.com bubble. Time will tell.

Appendix—Resources on ICOs

Autonomous Research, June 2018

Andreesen Horowitz, 2018

Initial Coin Offerings: A Strategic Perspective

PwC and Crypto Valley, June 2018

How to (Not) be a Shitcoin: What I’ve Learned About Markets, Psychology and Value Creation

Meltem Demirors SlideShare; September 7, 2018

Blockchain and cryptocurrency reading list

Robert Miller in Medium; November 26, 2017

Chasing fake volume: a crypto-plague

Sylvain Ribes in Medium; March 10, 2018

Vijay Boyapati in Medium; March 2, 2018

Blockchain Governance: Programming Our Future

Fred Ersham in Medium; November 27, 2017

Thanks to Dr. Jody Ranck, Dr. Charles Bruce, and Leonard Kish for their comments on an earlier draft of this article.

Robert Miller is CEO of Honeycomb Health and an early advocate for blockchain in the healthcare space. He manages a blog and a newsletter you can find at http://bertcmiller.com/

Vince Kuraitis, JD/MBA is an independent healthcare consultant with over 30 years’ experience across 150+ healthcare organizations and writes at www.e-CareManagement.com.